The PMT function in Excel calculates the payment for a loan that has constant payments and a constant interest rate. This formula will not work with a flexible interest rate.

=PMT (rate, nper, pv, [fv], [type])

- Rate: Interest Rate per period

- Nper: The number of periods

- Pv: Present value of loan/investment

- Fv: Future value of the loan/investment – This is optional. If left blank, it will default to zero.

- Type: Defines if the payment is made at the start or end of the period. If left blank, defaults to zero.

0 – Payment is made at the end of the period

1 – Payment is made at the beginning of the period

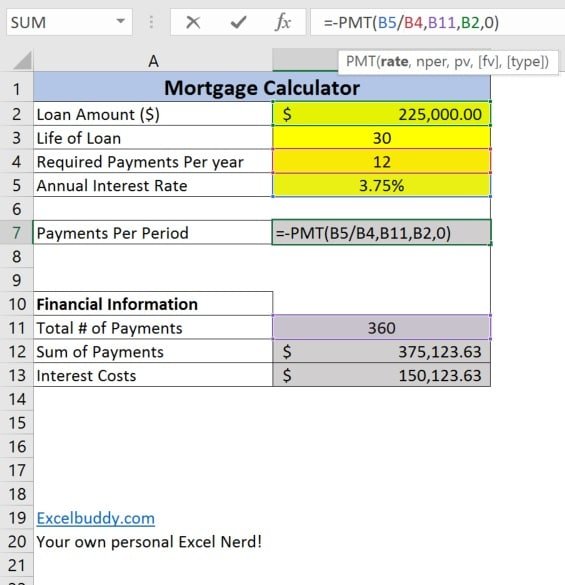

PMT Function in Excel Example

In the above example, we are taking out a loan for $225,000 with a 30 year fixed interest rate of 3.75% (Very good rate). Over 30 years, we end up paying $375,123.63, with $150,123.63 in interest.

The above calculation using the PMT Function does not account for Homeowners Insurance or local/state taxes. Modifying the spreadsheet to include these calculations is very easy.

Pingback: Amortization Schedule in Excel - Excelbuddy.com